alameda county property tax phone number

The system may be temporarily unavailable due to system maintenance and nightly processing. Property Tax Information Telephone.

City Of Oakland Check Your Property Tax Special Assessment

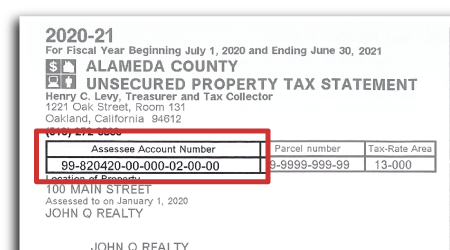

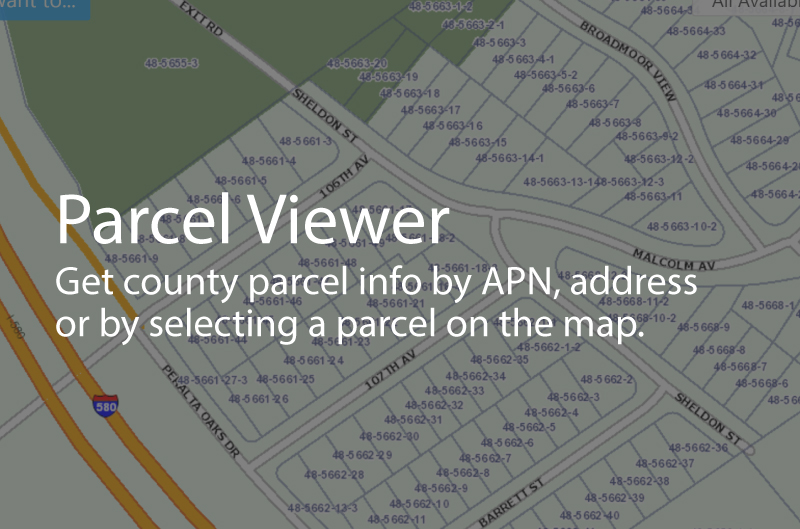

Enter your Assessors Parcel Number APN.

. A message from Henry C. Find out about meetings request City services through OAK 311 or contact the Mayor and City Council. This generally occurs Sunday.

Office closed on Alameda County holidays Links Department Website. 1221 Oak Street Room 131 Oakland CA 94612 5102726800 Monday - Friday. The Alameda County Treasurer-Tax Collector is pleased to announce that the AC Property App is now available on Apple devices.

Alameda County has its own mobile app for property tax payments. The Treasurer-Tax Collector. You can place your check payment in the drop box located at the lobby of the County.

Address County of Alameda Administration Building 1221 Oak Street Suite 555 Oakland CA 94612. Alameda County Assessors Office 1221 Oak Street Room 145. If not paid by this date the tax will include a delinquent penalty of 10 and a delinquent cost of.

Many vessel owners will see an increase in their 2022 property tax valuations. 1221 Oak Street Room 131 Oakland CA 94612 510 272-6800 510 272-6807 - FAX Call Center Hours. You can use the interactive map below to look up property tax data in Alameda County and beyond.

The official website of the City of Oakland. Lookup or pay delinquent prior year taxes for or earlier. Contact Us - Treasurer-Tax Collector - Alameda County.

The 2022-2023 Unsecured Property Tax was due on Wednesday August 31 2022. The facility is located at 5325 Broder Boulevard Dublin CA 94568 and can. Alameda County Treasurer-Tax Collector.

Assessors Office Public Inquiry 1221 Oak Street Room 145 Oakland CA 94612 510 272-3787 510 272-3803. 510 272-3836 Toll Free. Alameda County has its own mobile app for property tax payments.

Alameda County Property Tax Form September 29 2022 March 25 2022 by tamble You can sign up on-line or by mailing the registration form on the federal government office. If you want to pay by phone the number is 510-272-6800. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900Alameda County collects on average 068 of a propertys.

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. The valuation factors calculated by the State Board of Equalization and. The tax year must be entered as 4 digits ie 2002.

The facility is located at 5325 Broder Boulevard Dublin CA. 7600 Dublin Blvd 270 Dublin CA 94568. Alameda County Assessors Office 1221 Oak Street Room 145.

Alameda County Assessors Office 1221 Oak Street Room 145. The tax year must be entered as 4 digits ie 2002. The County of Alameda explicitly disclaims any representation and warranties including without limitation the implied warranties of merchantability and fitness for a particular purpose.

Dear Alameda County Residents. 1221 Oak Street Room 131. You can lookup your assessed value property taxes and.

1221 Oak Street Room 131 Oakland CA 94612. 7600 Dublin Blvd 270 Dublin CA 94568.

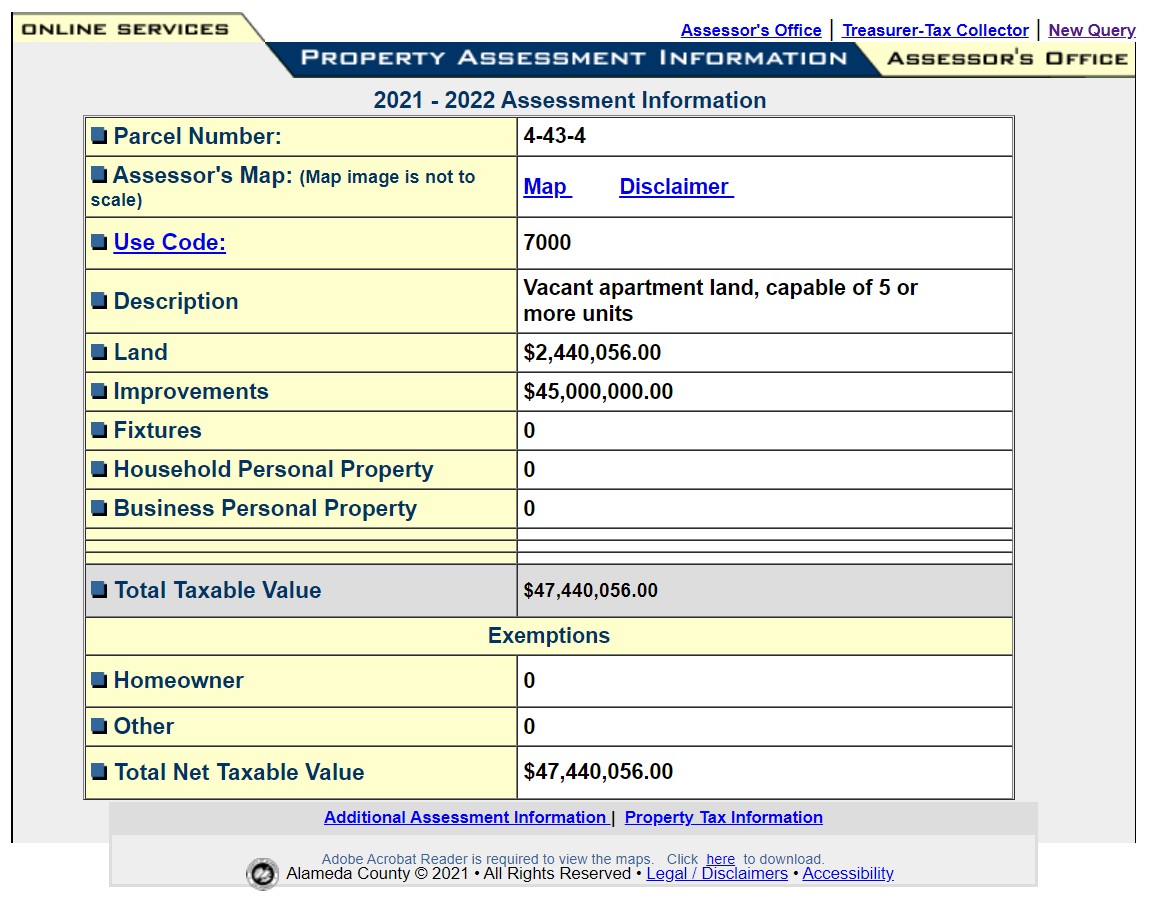

Property Information Alameda County

Senior Exemption Waiver Measure I

Alameda County Property Tax Tax Collector And Assessor In Alameda

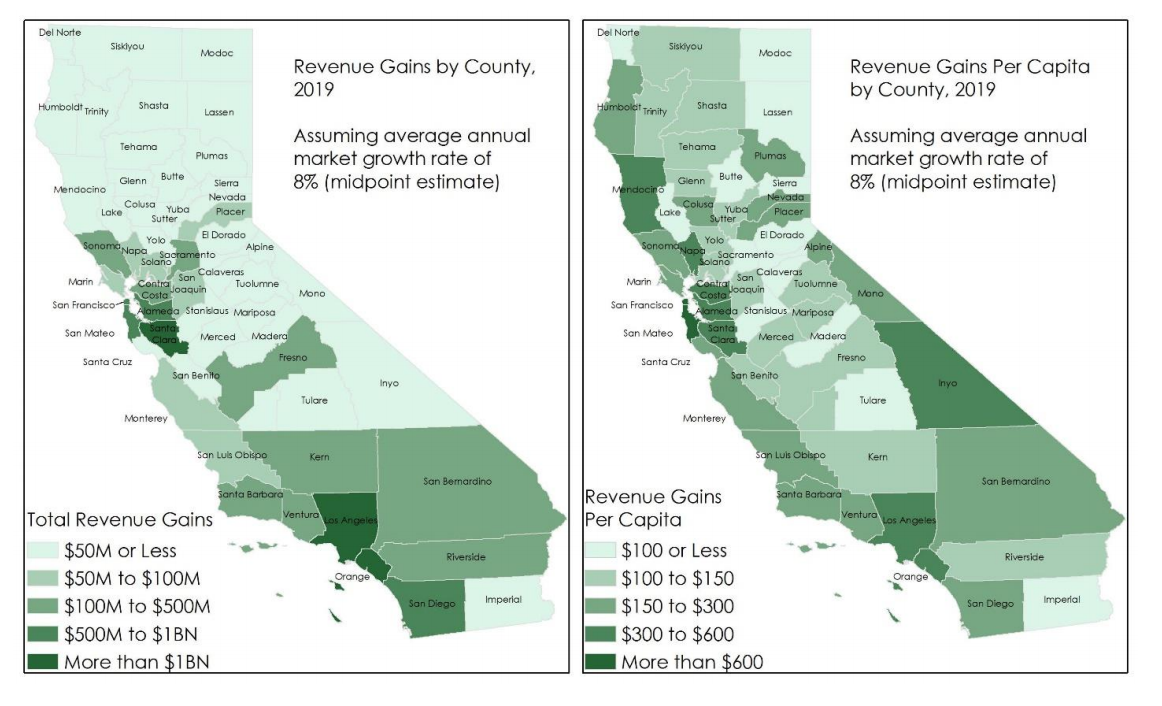

The Split Roll Initiative California S New Hope For Its Property Tax Loophole Berkeley Political Review

Home Treasurer Tax Collector Alameda County

Proposed Lenoir County Budget Increases Property Taxes Neuse News

Contact Us Treasurer Tax Collector Alameda County

Customer Success Story Alameda County Industrial Company

How To Pay Property Tax Using The Alameda County E Check System Watch Alameda County Treasurer Tax Collector Hank Levy Explain How To Pay Your Taxes Online Easier And Faster Using E Check

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Michael Barnes Albany City Council Meeting Comments And More Page 2

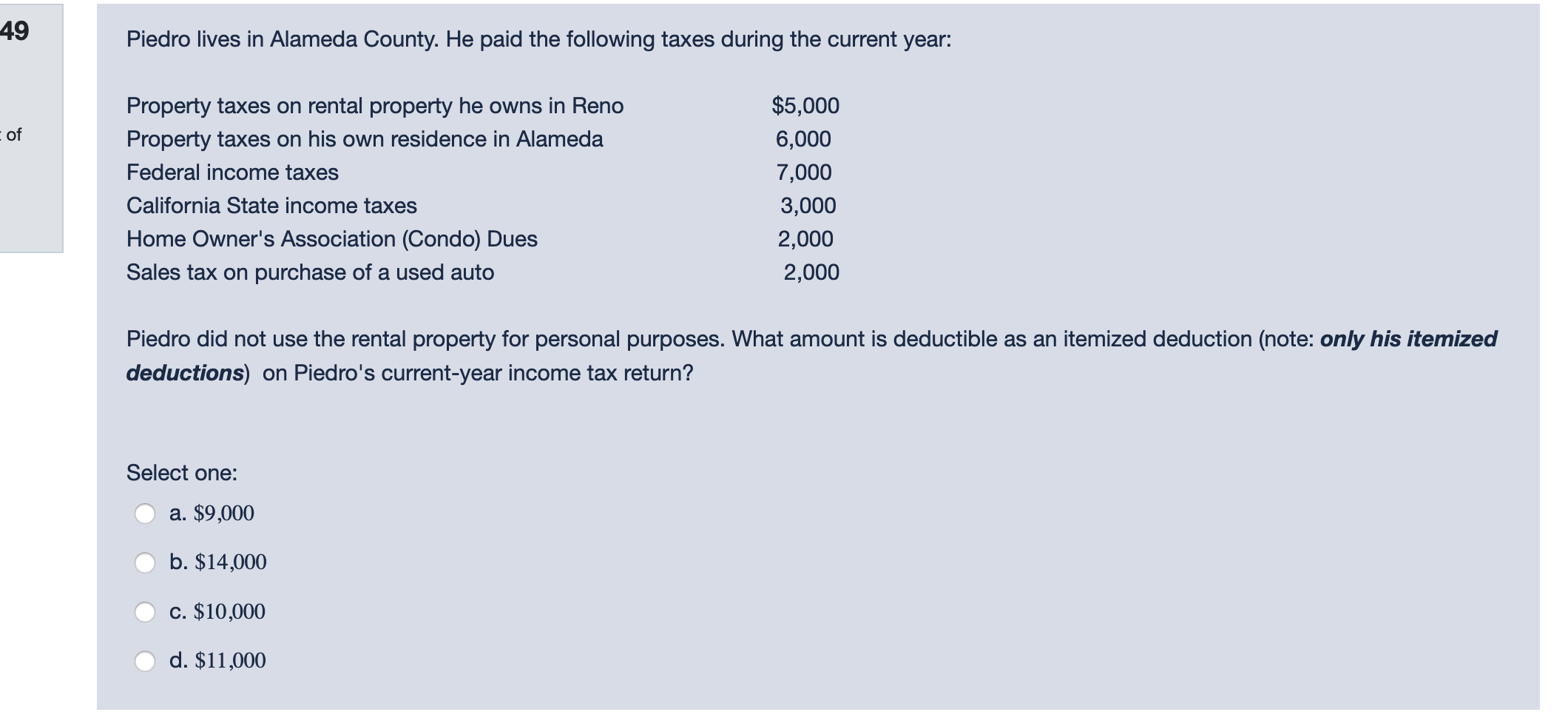

49 Piedro Lives In Alameda County He Paid The Chegg Com

How Some Bay Area Home Buyers Are Saving Thousands A Year In Property Taxes

Record Number Bail On Property Taxes East Bay Times

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates